In a recent development, we examine the question of whether luxury resellers should compensate buyers for the appreciated value of counterfeit items. This discussion highlights a significant concern in the luxury resale market, raising questions about consumer expectations and trust within this thriving industry.

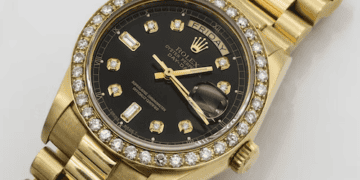

Three years ago, in March 2020, a woman (referred to as Elizabeth to protect her privacy) purchased a vintage Rolex as a 40th birthday gift for herself. She acquired the watch from The RealReal, a reputable luxury consignment platform that provided her with a certificate of authenticity for the item, albeit without the original box or papers.

Although the absence of original documents raised some initial concerns, Elizabeth had the watch resized at a Rolex store, and no issues were raised. Unfortunately, the watch stopped working in September 2023, and when she sought servicing at another Rolex store, she received an unexpected revelation. The watch contained aftermarket parts, rendering it unrepairable and indicating it was a counterfeit, referred to as a “superfake.”

Elizabeth returned the watch to The RealReal, where an authenticator confirmed its counterfeit nature. The RealReal agreed to refund her the initial purchase price of $9,295. However, an unexpected dilemma emerged when Rolex appraised the watch’s current market value at nearly $15,000, significantly higher than its purchase price.

Elizabeth faced a financial loss as the refunded $9,295 had depreciated in value due to inflation. This situation underscores a unique aspect of the luxury resale market, where platforms like The RealReal, Rebag, and Fashionphile encourage customers to view their luxury items as financial investments that can appreciate in value over time.

Luxury resellers emphasize this investment angle, offering initiatives such as Rebag Infinity, ensuring a minimum 70% return on resold items within six months, and eBay’s Terapeak, enabling customers to assess the historical prices of their purchases for long-term financial considerations.

Elizabeth reported that The RealReal offered to compensate her for the appreciated value in store credit, which exceeded their obligations. However, she expressed a preference for receiving the refund in cash, as she felt compelled to use the store credit if she decided to purchase another watch in the future.

Most major luxury resale companies have return policies, typically allowing returns for any reason within a specified period. Some, like The RealReal, offer to reauthenticate products at any time, while others, like Fashionphile, have a lifetime return policy for counterfeit items with full refunds. Rebag and The RealReal did not respond to requests for comments.

To combat counterfeits, resale platforms have made significant efforts to enhance authentication processes, including the utilization of AI-powered tools. Despite these measures, even luxury brands can sometimes be deceived, as demonstrated by Elizabeth’s case.

According to Rania Sedhom, an attorney specializing in fashion companies, resale platforms are not legally obligated to refund the excess value beyond the original purchase price. Many resellers explicitly state in their terms of service that they are not responsible for any damages, including loss of profits.

Elizabeth’s experience has left her disheartened, not only due to the loss of $5,000 in appreciated value but also because she missed out on three years of sentimental attachment to the watch. As a result, she has lost trust in the secondhand market and no longer finds the discounts offered by such platforms worth the compromise.

This situation underscores the need for clear and consistent policies in the luxury resale market, both in terms of counterfeit detection and compensation for affected customers. It also highlights the importance of consumer trust in maintaining a thriving industry

Get the latest supply chain report news insights at The Supply Chain Report. For international trade resources, visit ADAMftd.com.

#LuxuryResale #CounterfeitMarket #TheRealReal #Rebag #Fashionphile #Superfake #Rolex #LuxuryWatch #ConsumerTrust #SecondhandMarket #ResaleMarket #AuthenticationTools #CounterfeitDetection #LuxuryInvestment #InflationImpact #FinancialLoss #StoreCredit #CashRefund #ResalePolicies #ConsumerProtection #VintageRolex #LuxuryWatchMarket #AIAuthentication