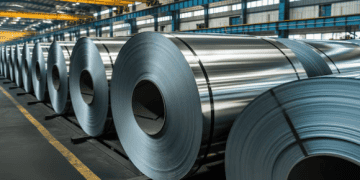

The implementation of a 25% tariff on imported steel and aluminium by the United States, effective March 4, is expected to create challenges for Vietnamese exporters. The measure aims to support domestic production but may affect key industries reliant on international trade.

According to the Vietnam Steel Association (VSA), the US is currently Vietnam’s third-largest export market for steel, accounting for 13% of total steel export turnover, following ASEAN and the EU. While this level of dependency is moderate, major steel manufacturers in Vietnam may experience some impact.

Trương Hiền Phương, Senior Director at KIS Vietnam Securities, noted that while the new tariffs will influence Vietnam’s steel exports, the overall effect may be limited, as the US is not the primary destination for these products. Companies such as Hòa Phát Group, Hoa Sen, and Nam Kim Steel continue to have alternative markets to offset potential declines.

However, the aluminium sector is expected to face greater challenges. The US previously imposed a 10% tariff on aluminium imports, and the increase to 25% is likely to raise costs for exporters.

Trương Hoàng Nam, Director of EuroHa Joint Stock Company, a major aluminium exporter to the US, expressed concerns over the increased tariff rate. He noted that at 10%, Vietnamese aluminium remained competitive, but at 25%, rising costs could make it difficult to retain customers.

In response, EuroHa is collaborating with the Vietnam Aluminium Association and the Trade Remedies Authority of Vietnam to assess the situation and explore potential strategies to mitigate financial impacts.

Economic expert Đinh Trọng Thịnh sees the tariff changes as both a challenge and an opportunity. While higher tariffs may create pricing difficulties for Vietnamese exporters, he pointed out that other key markets, including the EU, Canada, and Mexico, face similar tariff rates, meaning that Vietnam’s competitiveness remains relatively stable.

For the steel industry, Thịnh noted that Vietnam may still find opportunities in the US market, as many exporting countries will be subject to the same tariff structure. Regarding aluminium, he acknowledged that higher tariffs could reduce demand, requiring businesses to adjust pricing strategies and explore diversification efforts.

Dương Đức Quang, Deputy General Director of the Vietnam Commodity Exchange (MXV), advised businesses to take a proactive approach, focusing on enhancing production efficiency and seeking new markets to reduce reliance on the US. He emphasized that investing in advanced technology to produce higher-value aluminium products and closely monitoring trade policies could help mitigate potential disruptions.

Quang also suggested that businesses expand their export markets by prioritizing countries with free trade agreements with Vietnam. Meanwhile, Thịnh highlighted the importance of strengthening the domestic market to reduce dependence on major export destinations. Optimizing logistics and lowering production costs could further improve the competitiveness of Vietnamese steel and aluminium producers.

While the 25% tariff presents challenges, experts agree that it does not create an insurmountable barrier. The tariff applies to multiple countries, ensuring that Vietnam remains competitive within the global market.

US Ambassador to Vietnam Marc Knapper reaffirmed that the United States values its trade partnership with Vietnam and expressed optimism about continued economic cooperation, particularly as 2025 marks the 30th anniversary of diplomatic relations between the two nations.

Stay informed with supply chain news on The Supply Chain Report. Learn more about international trade at ADAMftd.com.

#TradePolicy #SupplyChainNews #ExportUpdate #VietnamEconomy #GlobalTrade