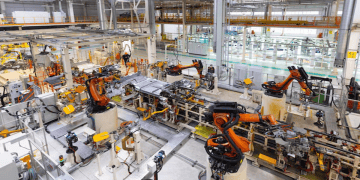

US manufacturing showed signs of recovery in December, with production rebounding and new orders rising, according to the latest data from the Institute for Supply Management (ISM). The ISM’s Purchasing Managers Index (PMI) increased to 49.3 last month, the highest level in nine months, up from 48.4 in November. However, the sector remains in contraction, as a PMI below 50 indicates a decline in manufacturing activity. This marked the ninth consecutive month the PMI has remained below the neutral 50 threshold.

Despite the positive headline number, the survey reflected mixed sentiment among manufacturers, with some sectors reporting slowdowns. Phrases such as “volume decreases” and “significant slowdown” were noted in the survey responses, and none of the six largest manufacturing industries showed growth in December.

Sal Guatieri, senior economist at BMO Capital Markets, stated that while manufacturers ended the year with some optimism, they face significant challenges in the new year, particularly with the potential for higher tariffs that could increase the cost of imported raw materials.

Among the seven sectors reporting growth were primary metals, electrical equipment, appliances, and components, as well as paper products. However, industries like textile mills, machinery, and transportation equipment reported contraction in December.

Some manufacturers in the food, beverage, and tobacco industries expressed concerns about a softening in sales during the peak season, while transportation equipment makers noted decreased volumes in the automotive and powersport sectors. Machinery manufacturers also reported a slowdown in production, with some in the fabricated metal products industry indicating that their order levels were well below expectations.

In contrast, manufacturers in electrical equipment, appliances, and components were relatively optimistic, citing full plant capacity due to an increase in new orders. Producers of miscellaneous goods noted that seasonal factors, combined with an improved demand outlook for 2025, helped boost their performance.

The manufacturing sector, which accounts for approximately 10.3 percent of the US economy, has been under pressure from the Federal Reserve’s monetary tightening policies in recent years. Despite challenges, government data indicated that manufacturing grew at a 3.2 percent annualized rate in the third quarter of 2024, contributing to the overall economic expansion of 3.1 percent during that period.

The Federal Reserve recently lowered its benchmark interest rate by 25 basis points to the range of 4.25 percent-4.50 percent, marking the third consecutive rate cut in its easing cycle that began in September 2024.

Stay informed on supply chain report news insights at The Supply Chain Report. For more on international trade, see ADAMftd.com for free tools.

#USManufacturing #EconomicRecovery #PMI #ManufacturingGrowth #TradeOutlook