In the wake of a robust year for the luxury sector, several prominent luxury brands have actively expanded their retail presence, according to the latest luxury report from JLL. Major luxury conglomerates, including LVMH, Kering, and Richemont, collectively added 650,000 square feet of retail space in the past 12 months.

While China’s post-Covid recovery has been relatively slow, the U.S. luxury market saw significant growth, with sales reaching $70 billion in the previous year, marking a 9% increase from 2022. This surge accounted for 34% of global luxury sales, as reported by Bain & Company. Notably, LVMH, the world’s leading luxury conglomerate, opened 108 new stores in the U.S., featuring renowned brands such as Louis Vuitton, Dior, Loewe, and more. Kering closely followed suit by introducing 100 new stores for brands like Gucci, Saint Laurent, Bottega Veneta, and Balenciaga. The relationship between growth and store expansion is intertwined, as increased demand justifies investment in retail expansion, and new stores allow brands to acquire customers and boost awareness, engagement, and conversion.

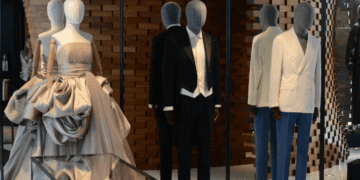

In terms of location and size, luxury brands tend to prioritize larger store spaces, particularly in major cities on the east and west coasts. On average, new leases exceed 5,000 square feet, emphasizing the sector’s commitment to crafting distinct, spacious, and upscale environments that invite shoppers to explore and immerse themselves in the brand experience. Research by JLL highlights a continued focus on prime locations in cities like New York, Los Angeles, and Miami, with 55% of new stores opening in New York and California in 2022. New York, in particular, demonstrated resilience in the aftermath of the pandemic, with numerous brands either returning to Madison Avenue or establishing a presence there for the first time. Notable additions include Hermes, Valentino, Lanvin, and Van Cleef & Arpels.

Luxury Stores Elevate Shopping Malls and Create Premium Destinations

Shopping mall operators are increasingly seeking to attract luxury brands to enhance their image and provide shoppers with a premium experience. JLL’s report indicates that 38% of new stores opened by luxury retailers in the past year were located in shopping malls that have refocused on offering luxury options. Miami’s Aventura Mall, for instance, significantly expanded its luxury offerings following extensive renovations and expansion. This transformation has resulted in an elevated shopping experience compared to its previous state just five years ago. The mall now boasts a dedicated wing housing luxury brands like Hermès, Louis Vuitton, and Cartier, with plans to introduce additional brands like Ferragamo and Amiri.

Other malls across the United States are also prioritizing the expansion of their luxury sections. Westfield Topanga in California recently unveiled a new luxury wing, featuring a 7,500 square-foot Hermès store, as well as renowned brands like Bottega Veneta, Burberry, and Celine. Enhancing the shopping experience through premium stores and refreshed spaces has become a pivotal strategy for malls aiming to revitalize themselves after experiencing declining foot traffic and appeal over the past decade. Mall operators that have successfully reinvented their properties into desirable shopping destinations are now attracting sought-after brands and increased foot traffic.

As the luxury industry continues to experience remarkable growth since 2022, leading brands are capitalizing on this momentum by expanding their retail presence. Notably, shopping malls and iconic luxury destinations like Madison Avenue are once again becoming attractive, welcoming some of the most renowned luxury brands in the past year. However, premium retail space, especially in larger formats favored by luxury brands, is becoming increasingly limited, which may pose challenges for the sustainability of the current expansion trend. Additionally, industry consolidation may further complicate the ability of new and smaller luxury players to grow their retail footprint, potentially creating opportunities for unique store concepts such as pop-ups, showrooms, and intimate boutique experiences that offer distinctive luxury shopping experiences.

Stay on top of supply chain news with The Supply Chain Report. Enhance your international trade knowledge with free tools from ADAMftd.com.

#LuxuryBrandsExpansion #LVMH #Kering #Richemont #LuxuryRetailGrowth #LuxurySector #LuxuryMarket #RetailExpansion #NewYorkLuxury #CaliforniaLuxury #LuxuryShopping #LuxuryShoppingExperience #HighEndRetail #LuxuryMalls #AventuraMall #WestfieldTopanga #MadisonAvenue #LuxuryStoreLeases #PrimeRetailLocations #USLuxuryMarket #ShoppingMallRenovations #JLLReport #BainReport #LuxuryBrandsUSA