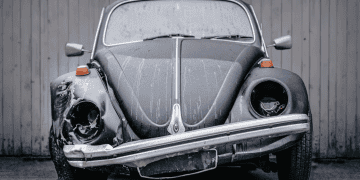

A recent variation in the notorious “crash-for-cash” scam is causing concerns among insurers and law enforcement in the UK. Traditionally, this fraudulent scheme involves criminals orchestrating deliberate car accidents to claim insurance payouts. However, the latest twist in the scam sees perpetrators targeting their victims with increased sophistication and planning.

The Insurance Fraud Bureau (IFB) has reported a rise in cases where scammers intentionally cause minor collisions, often at roundabouts or in heavy traffic. The objective is to ensure that the innocent driver appears at fault. Once the collision occurs, the scammers make inflated claims for vehicle damage, personal injury, and other losses, significantly driving up the cost for insurers.

IFB Director Ben Fletcher highlighted that these staged accidents are meticulously planned. “The criminals involved are highly organized and methodical in their approach, making it difficult for victims to realize they’ve been targeted until it’s too late,” Fletcher explained. He emphasized the importance of vigilance and awareness among drivers to recognize potential warning signs of this scam.

Insurance companies are also stepping up their efforts to combat these fraudulent activities. Advanced data analytics and machine learning are increasingly employed to identify patterns and anomalies that might indicate a crash-for-cash scenario. This technological approach is crucial in preventing the success of these scams and minimizing their financial impact on the industry.

Law enforcement agencies are working closely with insurers to investigate and prosecute those involved in crash-for-cash schemes. The collaborative efforts aim to dismantle the organized networks behind these fraudulent activities. Recent arrests and convictions have highlighted the seriousness with which authorities are addressing the issue.

Drivers are advised to remain cautious, particularly in situations where another vehicle seems to be driving erratically or attempting to engage in unusual maneuvers. The IFB recommends using dashcams as an effective tool to provide evidence in the event of a suspicious collision. Additionally, drivers should report any suspicious activity to their insurers and the police promptly.

The ongoing evolution of the crash-for-cash scam underscores the need for continuous vigilance and adaptation by both insurers and law enforcement. As scammers become more inventive, the industry must stay ahead with innovative solutions and collaborative efforts to protect innocent drivers and maintain the integrity of the insurance system.

Get the latest supply chain report news at The Supply Chain Report. Learn more about international trade with tools from ADAMftd.com.

#CrashForCash #InsuranceFraud #UKScam #FraudAlert #InsuranceFraudBureau #CrashScam #VehicleFraud #FraudPrevention #InsuranceIndustry #LawEnforcement #ScamAlert #DashcamEvidence #FraudDetection #InsuranceFraudAwareness #ScamPrevention #DriverSafety #InsuranceClaims #FraudInvestigation #ScamAwareness #InsuranceScam #FraudAlertUK