HÀ NỘI — Vietnam’s stock market opened 2025 on a positive note, with the VN-Index rising slightly as it approached the 1,270-point mark. Despite the gain, liquidity continued to be subdued, reflecting ongoing weakness in trading activity, while foreign investors returned to net selling, although at a moderate pace.

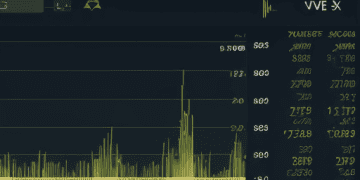

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index increased by 2.93 points, or 0.23%, closing at 1,269.71 points. The market saw more advancing stocks than decliners, with 183 stocks rising and 124 falling. However, trading liquidity decreased further, with a total value of approximately VNĐ10.8 trillion (US$424.37 million) and nearly 429 million shares exchanged.

Meanwhile, the VN30-Index, which tracks the 30 largest stocks by market capitalization on the HoSE, saw a slight decline, dropping 1.55 points or 0.12%, to settle at 1,343.2 points. Of the 30 stocks in the index, 12 posted gains, 11 declined, and 7 remained unchanged.

The banking sector led the day’s gains, with several large banks seeing positive movement. The Bank for Investment and Development of Vietnam (BID) rose 1.73%, contributing over 1.1 points to the VN-Index. Other notable gainers included the Bank for Foreign Trade of Vietnam (VCB), which climbed 0.77%, and the Vietnam Joint Stock Commercial Bank for Industry and Trade (CTG), which increased by 0.79%. Additionally, Hòa Phát Group JSC (HPG) and Vietnam Airlines JSC (HVN) gained 1.31% and 1.92%, respectively.

However, losses in some large-cap stocks held back broader market gains. The Vietnam Technological and Commercial Joint Stock Bank (TCB) fell 1.22%, Ho Chi Minh City Development Joint Stock Commercial Bank (HDB) declined 1.57%, and Vietnam Commercial Joint Stock Export Import Bank (EIB) dropped 2.85%.

On the Hà Nội Stock Exchange (HNX), the HNX-Index rose by 0.11%, closing at 227.69 points. Trading value on the exchange surpassed VNĐ625 billion, with over 36 million shares traded.

Foreign investors continued to be net sellers, offloading shares worth more than VNĐ98 billion on the HoSE.

During the opening of the trading year, Minister of Finance Nguyễn Văn Thắng highlighted the importance of improving market infrastructure, enhancing service quality, and attracting international investment. He emphasized the need for sustainable market development, transparency, and efficient trading systems.

Looking back at 2024, Vietnam’s stock market showed resilience and growth despite global macroeconomic challenges. The VN-Index increased by 12.11%, and the total market capitalization of listed stocks reached VNĐ7.08 quadrillion, which is approximately 70% of the country’s GDP. The number of investor accounts also rose to nearly 9.16 million, reflecting a 26% increase compared to 2023.

Looking ahead to 2025, the securities sector aims to achieve market reclassification, improve information technology infrastructure, ensure transparency and security, and enhance investor education to align with international standards, further integrating Vietnam into the global financial system.

Explore comprehensive supply chain news at The Supply Chain Report. Those interested in international trade can visit ADAMftd.com for free tools.

#VietnamStockMarket #ModestGain2025 #WeakLiquidity #VietnamEconomy #StockMarketTrends #InvestmentOpportunities #MarketGrowth