In the ever-evolving landscape of global trade, a new challenge has emerged that’s reshaping the oil transportation sector. Recent developments have seen a mix in oil prices as key players in the shipping industry are rerouting their paths away from the Red Sea. This strategic shift is a response to increased hostilities in the area, primarily due to attacks attributed to the Iran-aligned Houthi militant group in Yemen. These incidents have significantly impacted the usual flow of international shipping routes, bringing forth a complex scenario for stakeholders in the oil market.

Notably, the global oil benchmark, Brent, saw a marginal increase in its trading price, reaching $78.06 a barrel. In contrast, the U.S. West Texas Intermediate (WTI) futures experienced a slight decline, falling to $72.35 per barrel. This fluctuation in oil prices is a direct reflection of the ongoing geopolitical tensions and their ripple effects on global supply chains.

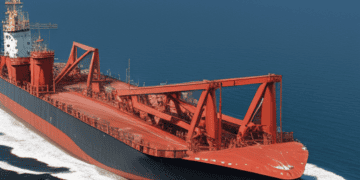

In recent times, the Houthi rebels have intensified their drone attacks against commercial vessels traversing the Red Sea, a critical corridor for international trade. The situation escalated to the point where leading shipping companies, including industry giants like Maersk, Hapag Lloyd, MSC, CMA CGM, and Evergreen, decided to divert their scheduled routes. This decision was soon followed by oil major BP, which paused its operations through the Suez Canal, citing concerns over deteriorating security conditions in the region.

Analysts are closely monitoring the situation, noting the potential impact on the global oil market. According to Ben Emons of NewEdge Wealth, approximately 9% of the world’s daily oil demand passes through the Suez Canal, making it a crucial node in the global oil supply chain. The disruption of this route is not only a concern for oil but also affects other commodities like coffee, soybeans, nickel, and palm oil, which rely on the same transit points.

While some experts, including those from Goldman Sachs, believe the overall impact on crude oil and LNG prices will be limited due to alternative routing options, the situation underscores the vulnerability of global supply chains to geopolitical events. The redirection of vessels through the longer Cape of Good Hope route, while a feasible alternative, adds to the complexity and costs of global trade.

In response to these growing security concerns, an international effort led by the U.S. is underway. This initiative, named Operation Prosperity Guardian, involves a multinational maritime force aimed at deterring further attacks in the Red Sea. Participating nations in this defense pact include Bahrain, Britain, Canada, France, Italy, the Netherlands, Norway, Seychelles, and Spain, reflecting a collaborative approach to securing vital international trade routes.

As the situation evolves, The Supply Chain Report will continue to provide in-depth analysis and updates on how these developments impact the broader landscape of international trade and logistics.

The implications of these disruptions extend beyond immediate price fluctuations. They highlight the intricate interplay between geopolitical stability and supply chain resilience. The Red Sea, a strategic maritime passage, is pivotal for the seamless movement of goods and commodities. Its disruption underscores the need for adaptive strategies in global logistics and supply chain management.

This situation also brings to light the importance of risk assessment and management in international trade. Companies are now compelled to reevaluate their supply chain strategies, considering alternative routes and contingency plans to mitigate risks associated with geopolitical unrest. This shift demands not only logistical agility but also a deeper understanding of the geopolitical landscape that shapes global trade dynamics.

Moreover, the collaborative effort in Operation Prosperity Guardian illustrates the growing recognition of the need for international cooperation in securing trade routes. It is a testament to the global nature of supply chains and the collective responsibility of nations to ensure their uninterrupted operation. Such initiatives are crucial in maintaining the flow of trade and upholding the stability of global markets.

As the world grapples with these challenges, it becomes evident that supply chain management is not just about logistics and transportation; it’s also about navigating the complex web of international relations and security concerns. The ongoing situation in the Red Sea is a stark reminder of how quickly and unexpectedly supply chains can be disrupted and how global trade is inextricably linked to geopolitical events.

In conclusion, the developments in the Red Sea region serve as a crucial case study for businesses and policymakers worldwide. They highlight the need for robust, flexible supply chain strategies that can adapt to a rapidly changing global environment. As we continue to monitor these events, The Supply Chain Report remains committed to providing insightful, timely analysis to help our readers navigate these turbulent waters.

Stay current with supply chain report news at The Supply Chain Report. For international trade resources, visit ADAMftd.com.

#GlobalTrade #OilTransportation #ShippingRoutes #RedSeaDisruption #GeopoliticalTensions #SupplyChainManagement #MaritimeSecurity #OperationProsperityGuardian #LogisticsAgility #OilMarketImpact #HouthiAttacks #InternationalCooperation #MarketAnalysis #BP #Maersk #CMA_CGM #Evergreen #HapagLloyd #MSC #GoldmanSachs