Wall Street’s main indexes declined sharply on Thursday as investors reacted to concerns over the potential impact of elevated U.S. tariffs on the global economy. The drop followed significant gains on Wednesday, when a 90-day tariff pause on some countries by President Donald Trump had driven the S&P 500 to its largest single-day percentage gain since 2008. The Nasdaq posted its biggest one-day rise since 2001.

However, on Thursday, the administration confirmed that tariffs on Chinese imports were raised to a cumulative 145%, according to a CNBC report citing the White House. China had previously imposed 84% tariffs on U.S. imports, intensifying trade tensions between the two countries.

Economic data released the same day showed that the U.S. consumer price index (CPI) unexpectedly fell by 0.1% in March. On a year-over-year basis, the CPI rose by 2.4%, below economist expectations of a 0.1% monthly increase and 2.6% annual gain, according to a Reuters poll. The Federal Reserve has not yet provided a clear assessment on how the recent tariff developments may influence the broader economy. Market data from LSEG indicated that traders are now pricing in nearly 90 basis points of interest rate cuts in 2025.

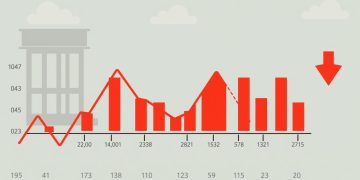

As of 12:19 p.m. ET, the Dow Jones Industrial Average dropped 1,872.86 points (4.61%) to 38,735.59. The S&P 500 fell by 298.72 points (5.45%) to 5,158.18, while the Nasdaq Composite declined 1,091.78 points (6.38%) to 16,033.20.

Investors were also focused on an upcoming auction of 30-year Treasury notes scheduled for 1:00 p.m. ET. Most sectors in the S&P 500 traded lower, with information technology and energy experiencing the steepest declines, each falling over 7%. Large technology firms were under pressure, with Apple, Microsoft, and Nvidia down 7%, 4.7%, and 8.5%, respectively.

Despite Wednesday’s rally, both the S&P 500 and the Dow Jones remain more than 8% below their levels prior to the announcement of reciprocal tariffs last week.

In corporate news, shares of CarMax declined 20.2% after the company reported lower-than-expected fourth-quarter earnings. The broader earnings season may provide additional insights into the state of corporate performance, with major banks, including JPMorgan Chase, set to report first-quarter results on Friday.

Market breadth was negative, with declining issues outnumbering advancing ones by a 7.15-to-1 ratio on the New York Stock Exchange and by 4.85-to-1 on the Nasdaq. The S&P 500 recorded no new 52-week highs and three new lows, while the Nasdaq Composite posted nine new highs and 84 new lows.

Stay informed with supply chain news on The Supply Chain Report. Learn more about international trade at ADAMftd.com.

#Tariffs #USChinaTrade #GlobalMarkets #TradePolicy #WallStreet #StockMarketCrash #EconomicUncertainty #TradeTensions #MarketVolatility #InternationalTrade