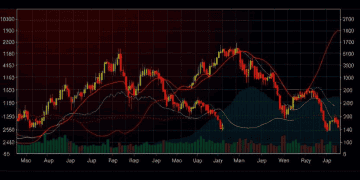

U.S. stock markets experienced substantial losses on Thursday, with the S&P 500 suffering its largest one-day percentage decline since June 2020, erasing a combined $2.4 trillion in market value. The decline was driven by concerns over new tariffs announced by U.S. President Donald Trump, which have raised fears of a global trade war and potential economic recession.

The Dow Jones Industrial Average also experienced its most significant one-day drop since June 2020, while the Nasdaq Composite saw its largest percentage loss since the market turmoil caused by the COVID-19 pandemic in March 2020. The trigger for the sharp decline was Trump’s imposition of a 10% tariff on most U.S. imports, as well as higher tariffs on several other countries. The move raised concerns about the broader economic implications and how global trading partners would respond. China and the European Union have vowed retaliation, while other countries, including South Korea, Mexico, and India, are seeking concessions before the tariffs take effect on April 9.

The volatility index, known as Wall Street’s “fear gauge,” rose above 30 for the first time since August, signaling increased market uncertainty. The S&P 500 dropped 4.84%, or 274.45 points, to 5,396.52. The Nasdaq Composite fell 5.97%, losing 1,050.44 points to close at 16,550.61, while the Dow Jones Industrial Average dropped 3.98%, or 1,679.39 points, to 40,545.93.

The losses stood in stark contrast to the optimism following Trump’s reelection in November, which had initially propelled U.S. stocks to record highs. Technology stocks, a major driver of the market’s growth in recent years, were among the hardest hit. Apple saw its worst one-day drop in five years, falling 9.2% due to the impact of higher tariffs on its China-based manufacturing. Other tech giants, such as Nvidia and Amazon, also saw significant losses.

Retailers were heavily impacted, with companies like Nike and Ralph Lauren falling by 14.4% and 16.3%, respectively, following the announcement of new tariffs on production hubs in countries like Vietnam, Indonesia, and China. Financial stocks were also affected, with major banks like Citigroup, Bank of America, and JPMorgan Chase & Co. falling between 7% and 12.1%.

The U.S. small-cap Russell 2000 index experienced its worst one-day decline since the pandemic’s onset, dropping 6.6%. Analysts noted that small-cap companies, often suppliers to larger corporations, are particularly vulnerable to the effects of the tariffs on their larger counterparts.

The energy sector was also hit hard, with the energy index sinking 7.5%, driven by a 6.8% drop in crude oil prices. This decline was fueled by concerns over reduced global demand due to the trade tensions and the OPEC+ decision to accelerate output hikes.

The consumer staples sector was the only one to close in positive territory, rising 0.7%. This sector, traditionally considered a safe haven during times of market stress, was bolstered by gains in companies like Lamb Weston, which rose 10% after reporting strong earnings.

Trading volume on U.S. exchanges surged to 20.90 billion shares, significantly higher than the 16.13 billion average for the past 20 trading days. Market participants continue to monitor the situation closely, with analysts predicting further volatility in the coming days.

Stay informed with supply chain news on The Supply Chain Report. Learn more about international trade at ADAMftd.com.

#USStocks #WallStreetLosses #TrumpTariffs #GlobalRecessionFears #S&P500 #MarketVolatility #TariffsAndDuties #EconomicImpact #TechStocks #TradeWarFears