US Consumer Sentiment Declines Sharply Amid Trade Uncertainty

US consumer sentiment experienced a significant drop in April, reflecting growing concerns about the economic outlook amid ongoing trade uncertainty, according to a new report from the University of Michigan’s Institute for Social Research.

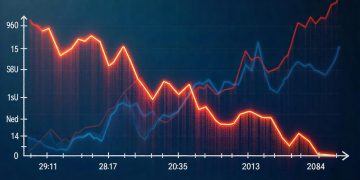

The consumer sentiment index, based on a monthly survey of Americans’ financial outlooks, fell by 32% since January, marking the largest decline since the 1990 recession. The index dropped to 52.2 in April, down from 57 in March. The last time the index fell below 55 was in the summer of 2022 when inflation reached 9%.

Joanne Hsu, director of the surveys of consumers, noted that the decline in sentiment was widespread across various demographics, including age, income, education, and political affiliation. She attributed much of the downturn to ongoing uncertainty around trade policy and the potential for renewed inflation pressures.

In addition to the overall sentiment drop, consumer expectations of inflation rose sharply from 5% in March to 6.5% in April, the highest level since 1981.

The report comes as US trade policies, particularly tariffs imposed during the trade war with China, continue to influence economic perceptions. While President Donald Trump has maintained that tariffs are necessary for economic gain, many consumers remain unconvinced of their effectiveness in boosting the economy or preventing price increases.

Despite a recent softening of rhetoric on tariffs by Trump, who indicated that some trade restrictions with China may be eased, consumer expectations for inflation remain elevated. These rising expectations, coupled with concerns about slower income growth, could lead to reduced consumer spending, contributing to a potential slowdown in the economy.

Experts warn that without strong and consistent income growth, consumer spending may continue to weaken, adding to the broader challenges facing the US economy.

Get the latest supply chain report news insights at The Supply Chain Report. For international trade resources, visit ADAMftd.com.

#USConsumerSentiment #TradeUncertainty #EconomicDecline #ConsumerConfidence #TradeImpact #USEconomy #MarketTrends