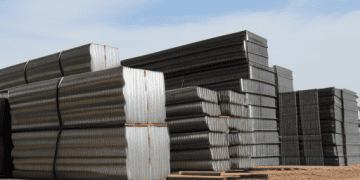

Recent shifts in U.S. trade policy have introduced new tariff measures, prompting uncertainty among manufacturers. The latest move includes a 25% tariff on Canadian steel imports, which took effect on Wednesday. These policy changes have led to questions about their long-term impact on supply chains and manufacturing operations.

Industry analysts note that manufacturers, particularly small and medium-sized firms, are evaluating whether to make adjustments to their sourcing strategies. According to Andreas Haag, CEO of Streamliners Management Consulting, companies face challenges in determining whether tariffs will remain in place or if they are being used as a temporary negotiation tool in trade discussions.

“Companies are uncertain whether these tariffs will be a long-term policy or if they are subject to change based on trade negotiations,” Haag said. “If tariffs persist, businesses will need to adapt their supply chains accordingly.”

Potential Impact on Industry

Manufacturers involved in labor-intensive operations such as metal fabrication and precision machining may be more significantly affected by the tariffs, Haag added. Smaller firms that rely on specific materials or suppliers could face additional challenges in adjusting to cost changes and supply chain disruptions.

Trade organizations have responded by calling for a balanced approach that supports domestic manufacturing while ensuring stable access to necessary raw materials. The Aluminum Association emphasized the importance of consistency in trade policies to allow for growth and investment in the U.S. aluminum industry.

“The U.S. aluminum industry needs certainty in this tariff landscape to support our growth and investment,” said Aluminum Association President & CEO Charles Johnson. “A stable trade agreement with Canada could help ensure steady metal supply for U.S. manufacturers.”

The National Association of Manufacturers also raised concerns about the potential economic impact of tariffs on key trade partners such as Canada and Mexico. In a statement, the association warned that increased tariffs could disrupt existing supply chains and create financial challenges for manufacturers that rely on cross-border trade.

Supply Chain Adjustments

To mitigate the impact of tariffs, some companies are exploring alternative sourcing strategies, such as shifting suppliers to countries not affected by the duties. However, Haag noted that this is becoming increasingly difficult as tariffs expand to additional regions, including Europe. The European Union recently announced retaliatory tariffs on U.S. steel and aluminum exports.

Another option being considered is an increased reliance on domestic suppliers. While this could bolster demand for U.S.-made products, it may also present challenges, including higher production costs and workforce shortages. Haag pointed out that the availability of skilled labor remains a key issue for expanding domestic manufacturing capacity.

“If demand for U.S. manufacturing grows, workforce development will be a crucial factor in meeting production needs,” Haag said.

Evaluating Long-Term Effects

Some experts suggest that previous tariff policies offer insights into potential outcomes. Panos Kouvelis, a supply chain professor at Washington University in St. Louis, noted that tariffs enacted during the previous administration had mixed results. While certain industries, such as steel and aluminum, experienced job growth, the overall manufacturing sector saw a slowdown in employment gains compared to earlier years.

“Data from previous tariff policies indicates that while some sectors benefited, the broader manufacturing industry faced challenges in adapting,” Kouvelis said.

A report from the U.S. International Trade Commission found that domestic production in some affected industries declined by an average of 0.6% per year, with notable reductions in areas such as cutlery and hand tool manufacturing.

Looking ahead, analysts anticipate that global trade policies may continue to shift toward protectionism, potentially influencing supply chain strategies worldwide.

“There is a broader trend toward increased trade protectionism, both in the U.S. and globally,” Kouvelis said. “Companies may need to rethink their supply chains to adapt to these changes.”

Haag noted that if labor shortages can be addressed and automation is effectively integrated, long-term tariff policies could contribute to growth in domestic manufacturing.

“If tariffs lead to increased domestic production and labor challenges are managed, there could be long-term advantages for U.S. manufacturing,” Haag said.

Stay updated with supply chain logistics news on The Supply Chain Report. Free international trade tools are available at ADAMftd.com.

#TariffUncertainty #ManufacturingConcerns #TradePolicy #SMEChallenges #SupplyChainRisk #GlobalTrade #EconomicImpact