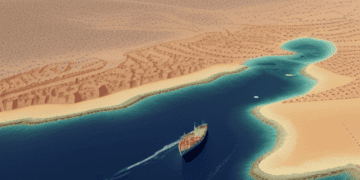

The Red Sea, long known as a crucial maritime passage, has recently become a focal point for complex navigational challenges. According to a recent Bloomberg report, sailors are facing daunting voyages through this area due to increased regional tensions.

Sailors who have braved this route shared their experiences, painting a picture of the heightened risks. Their testimonies reveal a shift in maritime operations, with many container ships now choosing longer routes, circumnavigating Africa to bypass the Suez Canal. This canal, a linchpin in global trade, typically sees about 12% of the world’s seaborne commerce.

One sailor recounted a harrowing incident where a projectile exploded close to their vessel, a stark reminder of the dangers lurking in these waters. Another spoke of responding to distress calls from attacked ships, underscoring the precariousness of this passage.

Recent data from IMF PortWatch highlights this issue, noting a steady flow of various carriers through the Bab el-Mandeb Strait, despite these known risks. The US Navy’s engagement in the area, including the sinking of three Houthi boats, along with Iran’s dispatch of a warship, further complicates the situation.

Beyond the immediate physical dangers, there are significant financial implications. Rerouting ships around the Cape of Good Hope in South Africa incurs additional costs – more fuel, extended travel times, and the resulting logistical complications on land. However, these costs are often deemed a necessary trade-off for ensuring the safety of crew and cargo.

Further developments in the Red Sea region continue to draw attention. For instance, Cosco’s decision to halt bookings to Israel due to escalating Houthi threats, and the persistent nature of these attacks as reported by a US Admiral, are notable. These incidents not only disrupt global trade but also pose a serious question about the future of maritime navigation in conflict-prone waters.

The broader impact of these tensions on global trade is significant. A potential military escalation in Taiwan, for example, could have far-reaching economic repercussions. Bloomberg Economics estimates that a conflict over Taiwan could cost around $10 trillion, approximately 10% of global GDP. This dwarfs the economic impacts of the Ukrainian war, the Covid pandemic, and the Global Financial Crisis.

The shipping industry, navigating through these turbulent times, faces multiple challenges. These range from the current situation in the Red Sea to other global issues like low water levels in the Panama Canal, stringent emissions targets, fluctuating demand, and increasing regulations.

In the coming weeks, Bloomberg Intelligence plans to host seminars in Singapore, Hong Kong, and Seoul. These events aim to discuss key opportunities and challenges in the container, tanker, and dry bulk markets, along with broader economic perspectives.

In summary, the current situation in the Red Sea is more than a regional concern; it’s a global issue with far-reaching implications for the shipping industry, international trade, and the global economy. As these challenges persist, they call for strategic adjustments and resilient solutions in the ever-evolving landscape of global trade and supply chain management.

Catch the latest supply chain news at The Supply Chain Report. Learn more about international trade at ADAMftd.com with free tools.

#RedSeaChallenges #MaritimeNavigation #GlobalTradeImpact #ShippingIndustry #SuezCanal #IMFPortWatch #Cosco #USNavy #HouthiThreats #TaiwanConflict #BloombergIntelligence #Logistics #SupplyChainManagement