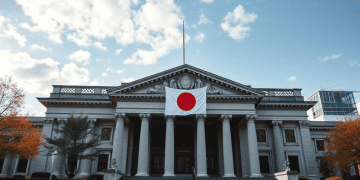

The Bank of Japan (BOJ) is focused on achieving a 2% inflation target, as measured by the overall consumer price index (CPI), on a sustained basis. This target was initially introduced in 2012 and has guided the bank’s monetary policy, including the implementation of a significant stimulus program that began in 2013.

In its approach, the BOJ assesses underlying inflation, which reflects long-term trends in price movements by excluding temporary factors such as fuel prices and volatile fresh food costs. This method is used to better capture inflation driven by the strength of the economy, though isolating these factors can sometimes prove challenging.

After years of stimulus, the BOJ ended its program last year and raised short-term interest rates to 0.5% in January, with the expectation that Japan is approaching a point where it can achieve stable 2% inflation. To achieve this goal, the central bank looks at core CPI, which excludes fresh food, and the “core-core” CPI, which also excludes fuel costs.

The divergence between the overall CPI and the core CPI has gained attention due to the rising costs of items such as rice, vegetables, and fuel, which are significantly impacting household expenses. In December, the overall CPI increased by 3.6% year-on-year, surpassing the 3.0% rise in core CPI and the 2.4% increase in core-core CPI.

Stay current with supply chain news on The Supply Chain Report. Free trade resources are available at ADAMftd.com.

#BankOfJapan #CPIInflationTarget #EconomicIndicators #JapanMonetaryPolicy #GlobalTradeInsights