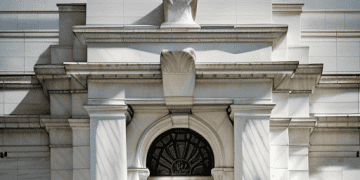

The Federal Reserve has issued a cease-and-desist order against Small Business Bank, based in Lenexa, Kansas, following a recent examination by the Federal Reserve Bank of Kansas City and the Office of the State Bank Commissioner of Kansas. The examination identified ongoing deficiencies in the bank’s risk management, anti-money laundering (AML) practices, and compliance with the Bank Secrecy Act (BSA).

This latest order comes after a similar action in September 2023, when the Federal Reserve had already cited shortcomings in the bank’s operations, including AML compliance, based on an examination conducted in October 2022.

As part of the new order, the Federal Reserve has mandated that Small Business Bank submit plans within 60 days to address the identified deficiencies in its BSA/AML compliance program. The plans must include measures to ensure sufficient resources and clear accountability for compliance, as well as enhanced risk assessments and independent testing of AML procedures.

The bank is also required to improve its customer due diligence processes and report any suspicious activities to law enforcement and supervisory authorities in a timely manner. Additionally, the bank must engage an independent third-party consultant to review its transaction monitoring system and suggest improvements.

To ensure compliance, Small Business Bank’s board must submit quarterly progress reports to the Federal Reserve, and the bank is prohibited from paying dividends without prior approval from the Federal Reserve and state regulators.

The bank, which primarily serves small and micro-business owners in the U.S., has agreed to the findings of the regulators and has entered a consent order, waiving its right to challenge the findings.

Stay informed with supply chain news on The Supply Chain Report. Free tools for international trade are at ADAMftd.com.

#FederalReserveUpdate #SmallBusinessCompliance #BankingRegulations2025 #FinancialTransparency #SmallBusinessBanking