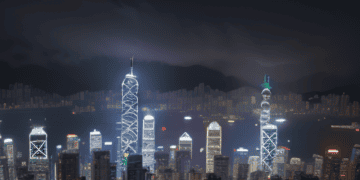

In a strategic move to maintain its status as a global financial hub, Hong Kong is adopting a welcoming stance towards cryptocurrencies, despite the industry’s recent challenges. The semi-autonomous Chinese territory is implementing a new regulatory framework aimed at ensuring the safe and stable operation of virtual assets.

Hong Kong authorities granted licenses to two cryptocurrency exchanges, HashKey Exchange and OSL, allowing them to offer retail trading of digital assets. This marks a significant shift in the region’s approach to virtual currencies, with officials emphasizing the need for a balanced regulatory system to foster trust in the industry. Julia Leung, CEO of the Securities and Futures Commission (SFC), highlighted the importance of well-structured regulations in her speech, acknowledging the enduring presence of cryptocurrencies.

The industry has welcomed the new guidelines, with Dave Chapman, co-founder of OSL, praising Hong Kong’s proactive risk management strategies and robust investor protections. This move positions Hong Kong distinctively within China, as mainland China continues to prohibit cryptocurrencies. Neil Tan, Chairman of the FinTech Association of Hong Kong, suggested that this decision reflects Hong Kong’s autonomy in financial policies under the “one country, two systems” principle. He speculated that the move could allow China indirect influence over the cryptocurrency industry and aid in the internationalization of the renminbi.

The global cryptocurrency landscape has been tumultuous, with high-profile collapses and regulatory challenges in the United States. Despite this, recent developments in the US, including new legislation and court rulings, have led to a resurgence in the market.

Experts have mixed views on Hong Kong’s timing in embracing cryptocurrencies. Lu Fangzhou, an assistant professor of finance at the University of Hong Kong, believes the region is late in capitalizing on the cryptocurrency trend. In contrast, Chapman remains optimistic about the transformative potential of blockchain technology and Hong Kong’s role in leading good practices in the digital asset industry.

Hong Kong’s history with cryptocurrencies is not new. The SFC granted the first virtual asset trading platform license in 2020 for institutional investors, and both Hong Kong and mainland China were previously central to cryptocurrency activities. Tan observed that many cryptocurrency firms originated from the region, contributing to Hong Kong’s continued appeal as a hub for crypto-related activities. Despite Beijing’s skepticism towards digital currencies, its recognition of blockchain technology’s importance is evident in Hong Kong’s favorable regulatory landscape.

Breaking supply chain news is just a click away at The Supply Chain Report. Enhance your knowledge of international trade at ADAMftd.com with free tools.

#HongKongCrypto #CryptocurrencyRegulation #HashKeyExchange #OSL #VirtualAssets #BlockchainTechnology #DigitalAssets #HongKongFinTech #CryptoRegulations #SFC #CryptoLicenses #CryptocurrencyExchanges #BlockchainInnovation #FinTechAssociation #HongKongSecurities #RenminbiInternationalization #CryptoIndustryGrowth #InvestorProtection #RiskManagement #CryptoMarket #HongKongFinance #ChinaCrypto #FinancialHub