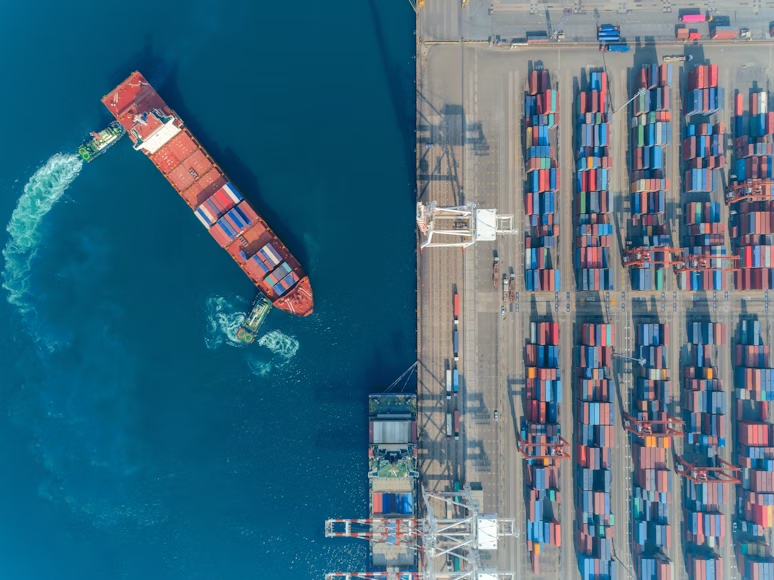

Global container shipping rates climbed modestly again this week, with the Drewry World Container Index (WCI) rising about 2 % compared with the previous week as spot freight pricing ticked higher on some major trade routes. This marks at least the second consecutive weekly increase in container rates after a period of softer pricing earlier in the year.

The upward movement reflects a divergent trend across trade lanes: while some routes, particularly between Asia and Europe, have seen firmer spot rate conditions due to steady demand and carriers managing capacity, other corridors like Transpacific lanes have shown mixed results—with some spot rates easing even as the overall index gains.

Analysts say recent rate gains are tied to seasonal booking patterns and carriers’ efforts to maintain pricing discipline amid ongoing volatility in global freight markets. However, despite the recent uptick, current container freight costs remain well below the extreme highs seen during pandemic‑era congestion, and there is still potential for prices to soften if demand weakens or capacity increases significantly.

For shippers and logistics planners, even small weekly changes in container rates can affect landed cost forecasts and contract negotiations, making it crucial to monitor the balance of cargo demand, carrier blank sailings and broader economic indicators that influence freight pricing.

#Breakingnews #SupplyChainNews #ContainerRates #FreightUpdate #GlobalShippingNews