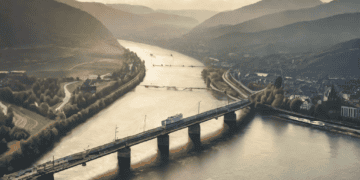

The water levels along the Rhine River in Europe are nearing a critical low point, threatening to disrupt the transport of substantial goods and commodities crucial for the continent’s trade. At Kaub, Germany, a pivotal transit spot for commodity shipments, the river’s levels are expected to plummet to 47 centimeters (18.5 inches) by the upcoming weekend, inching dangerously close to near-impassable conditions.

This impending closure of the Rhine could have far-reaching consequences, especially at a time when Europe grapples with severe energy shortages due to reduced natural gas supply from Russia, intensifying inflationary pressures. Climate change exacerbates the situation, adding another layer of complexity to the continent’s challenges. If the river becomes impassable, the flow of essential goods such as fuel and chemicals could grind to a halt, potentially exacerbating the ongoing energy crisis and tipping the region toward economic recession.

Already, low water levels have restricted coal shipments, leading to fewer available ships and reduced cargo capacity, consequently driving up transportation costs for coal. Past instances of decreased water levels in 2018 impacted Germany’s economic growth, illustrating the potential magnitude of the current situation. Moreover, with the current energy crisis amplified by reduced Russian supplies, the significance of the Rhine as an alternative means to compensate for lost energy resources becomes even more critical.

As a vital transportation route spanning roughly 800 miles (1,288 kilometers) from Switzerland to the North Sea, the Rhine plays a pivotal role in the delivery and export of crucial commodities such as heating oil, gasoline, and coal. Decreased water levels force barges to lighten their loads to navigate the river, further complicating the transport of goods.

Germany’s increased reliance on coal arises due to reduced Russian gas imports amid geopolitical tensions and sanctions. The International Monetary Fund has cautioned that a complete cessation of natural gas supplies from Russia could lead to a significant economic output loss for Germany.

The water levels at Kaub have recently hit their lowest since 2018, signaling potential disruptions for key industrial users. It’s important to note that the measured water level doesn’t equate to the actual depth of the river; hence, a deeper understanding of the conditions is necessary to gauge the severity accurately.

The diminishing water levels are already disrupting trade flows, limiting the capacity of fuel barges entering inland Europe. Switzerland, heavily reliant on the Rhine for oil-based fuel imports, is tapping into its strategic reserves. Furthermore, refinery outages in Germany, the Czech Republic, and Austria are exacerbating challenges in fuel supply across inland Europe.

Escalating shipping costs have become a significant concern, with transportation expenses for fuel to Basel, Switzerland, surging to over 200 euros per ton, a stark increase compared to previous months. The reduced cargo capacity of barges necessitates a higher number of vessels to transport the same volume of goods, further amplifying logistical challenges.

The impact extends beyond fuel, affecting the transportation of components crucial for gasoline production and petrochemical feedstocks like naphtha. Companies in various sectors are proactively responding to these challenges by building up stocks, chartering special barges, and employing alternative transportation methods. However, concerns linger over the strained capacity of road and railway transportation systems due to staffing shortages and handling issues, potentially hindering efforts to shift from river transport.

The looming threat of the Rhine River effectively closing underscores the intricate interdependencies in Europe’s supply chain. As companies brace for potential disruptions, challenges in diversifying transportation methods highlight the pressing need for proactive solutions amid this multifaceted crisis.

In anticipation of potential disruptions, companies are strategizing to mitigate the impact of the impending closure of the Rhine River. EnBW has been bolstering its coal stockpile, while BASF SE is chartering specialized barges designed to navigate low water conditions. Similarly, Evonik Industries AG has taken proactive measures by chartering additional ships and trucks to counterbalance the reduced cargo capacities on barges.

Despite these preparations, challenges persist. The transition of transportation from the Rhine to alternative modes like roads or railways faces hurdles. Companies specializing in logistics, such as VTG AG and Hoyer Group, report that their trucks and railway carriages are already operating at maximum capacity due to staffing shortages and logistical delays in railway operations. The increased demand for coal transportation since the Russia-Ukraine conflict further strains these logistics networks.

The situation remains fluid and dynamic, with uncertainties looming over the ability of companies to sustainably adapt to the potential closure of the Rhine River. As industries navigate the complexities of this multifaceted challenge, collaboration between stakeholders and innovative solutions will be pivotal in alleviating the strain on the supply chain and ensuring continued access to essential goods across Europe.

In conclusion, the impending threat of the Rhine River’s closure poses significant challenges to Europe’s trade and supply chain dynamics. The potential disruption of crucial commodities’ transportation underscores the need for proactive measures and adaptive strategies to mitigate the impact on the region’s economy and supply networks.

Stay current with supply chain report news at The Supply Chain Report. For international trade resources, visit ADAMftd.com.

#RhineRiver #SupplyChainDisruptions #EnergyCrisis #ClimateChangeImpact #LowWaterLevels #GermanyTrade #BASFSE #EvonikIndustries #EnBW #VTGAG #HoyerGroup #CoalTransport #ShippingChallenges #InflationPressure #GeopoliticalTensions #AlternativeTransport #LogisticsInnovation #EuropeanTrade #CommodityTransport #EnergyShortages #TransportationCosts